Forget the days of panicking over misplaced receipts and struggling to decipher cryptic bank statements. Managing your finances with financial apps in 2024 doesn’t have to be a chore. Financial technology, or FinTech for short, has introduced a wave of innovative apps designed to simplify your money management and empower you to take control of your financial future. These handy tools can be your secret weapon for getting organized, staying on budget, and achieving your financial dreams. From budgeting wizards to all-in-one financial dashboards, there’s an app out there designed to fit your unique needs and preferences.

Also, read: 10 Best Credit Cards to Rebuild Bad Credit: Unlock Your Financial Freedom

What Are Financial Planning Apps?

Financial planning apps do just what they say on the tin. These software applications are readily available on various devices, offering valuable assistance in managing your finances. Tailored to aid individuals in handling their finances effectively, these tools cover a spectrum of tasks. From budgeting and expense tracking to investment management, debt tracking, and savings planning, they provide comprehensive support. Particularly for those grappling with financial challenges, or those looking to change the way they bank, these tools can help take the stress out of money.

Simplify Your Money Life: Top 10 Financial Apps to Simplify Your Money Management in 2024

Financial apps can be a great way to take control of your finances and simplify your money management. With so many options available, it can be tough to decide which one is right for you. Here are some of the top-rated financial apps to consider in 2024:

Also, read: Top 10 Investment Strategies for a Volatile Market in 2024

1. YNAB (You Need A Budget)

YNAB (You Need a Budget) is a budgeting app designed for those who want to take control of their finances and break the cycle of living paycheck to paycheck. Unlike traditional budgeting apps that focus on tracking past spending, YNAB uses a proactive, zero-based budgeting system. This means you assign every dollar of your income to a job towards your bills, savings goals, and spending categories before the month begins. This empowers you to make intentional spending decisions and avoid overspending.

YNAB goes beyond just budgeting; it provides features like goal setting, personalized insights, and a focus on behavior change to help you develop a healthy relationship with money. With its user-friendly interface and robust features, YNAB is a powerful tool for anyone who wants to take charge of their finances and achieve their financial goals.

2. Empower Personal Dashboard (formerly Personal Capital)

Empower Personal Dashboard (formerly Personal Capital) is a powerful tool for taking control of your entire financial picture. It goes beyond simple budgeting by offering a comprehensive view of your finances, including bank accounts, investment portfolios, retirement savings, and even debt. This allows you to track your net worth, analyze spending habits, and identify areas for improvement.

Empower also boasts a suite of financial tools, like retirement planning calculators and access to professional advisors, empowering you to make informed decisions about your financial future. Whether you’re a seasoned investor or just starting, Empower Personal Dashboard can be your one-stop shop for achieving your financial goals.

Also, read: Top 10 Financial Planning Tips for Money-Savvy Americans in 2024

3. Goodbudget

Goodbudget is a budgeting app designed for those who prefer a straightforward approach. It leverages the envelope budgeting method, where you virtually allocate your income into designated categories like groceries, rent, and entertainment. This system provides a clear picture of how much you can spend in each area without going over budget. Goodbudget also shines in shared finances.

Couples or roommates can collaborate on the budget, track joint spending, and work towards common financial goals—all within the same app. With its focus on simplicity and its collaborative features, Goodbudget is a great choice for anyone looking to take control of their finances together.

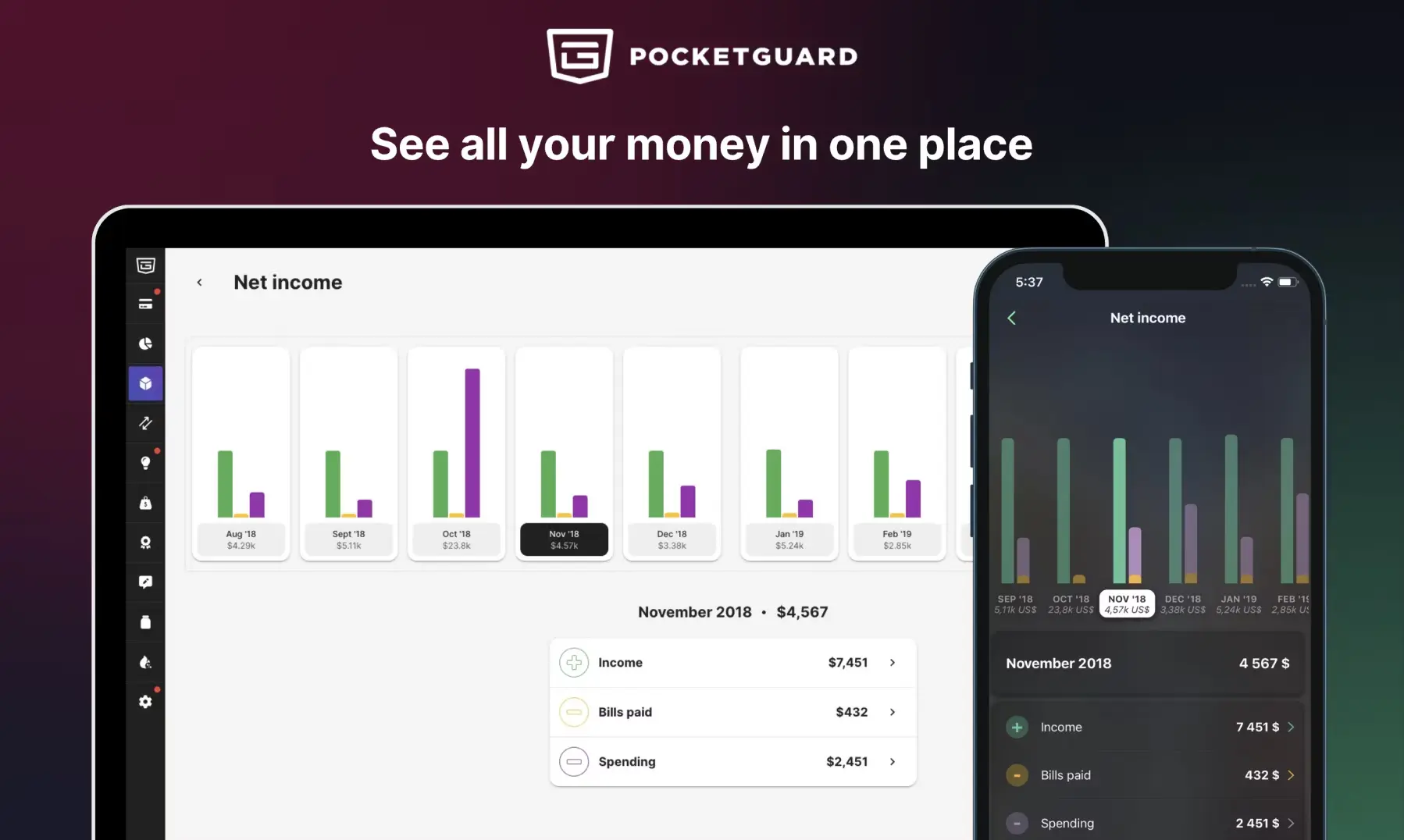

4. PocketGuard

PocketGuard is a budgeting app designed for those who want a quick and easy way to understand their finances. It connects to your bank accounts and credit cards to automatically track your income, spending, and bills. This gives you a real-time overview of your financial situation, allowing you to see exactly how much money you have left to spend each month.

PocketGuard doesn’t just track your spending; it also helps you find ways to save money by analyzing your bills and identifying areas where you might be able to negotiate a better rate. With its user-friendly interface and insightful analysis, PocketGuard is a great tool for busy individuals who want to take control of their finances without getting bogged down in complex budgeting systems.

Also, read: Top 10 Highest Currencies in the World

5. Honeydue

Honeydue is your secret weapon for financial harmony as a couple. This app tackles budgeting together, allowing you to connect your bank accounts and see your combined spending in one place. Gone are the days of mysterious purchases and spreadsheet showdowns. Honeydue fosters communication with features like emoji reactions to spending and the ability to ask your partner about specific transactions.

But it doesn’t stop at transparency. Honeydue empowers you to collaborate on financial goals, set clear spending limits by category, and get alerts when you’re nearing them. So ditch the late-night money talks and fragmented financial views. Honeydue brings budgeting together as a team, paving the way for a more secure and stress-free financial future together.

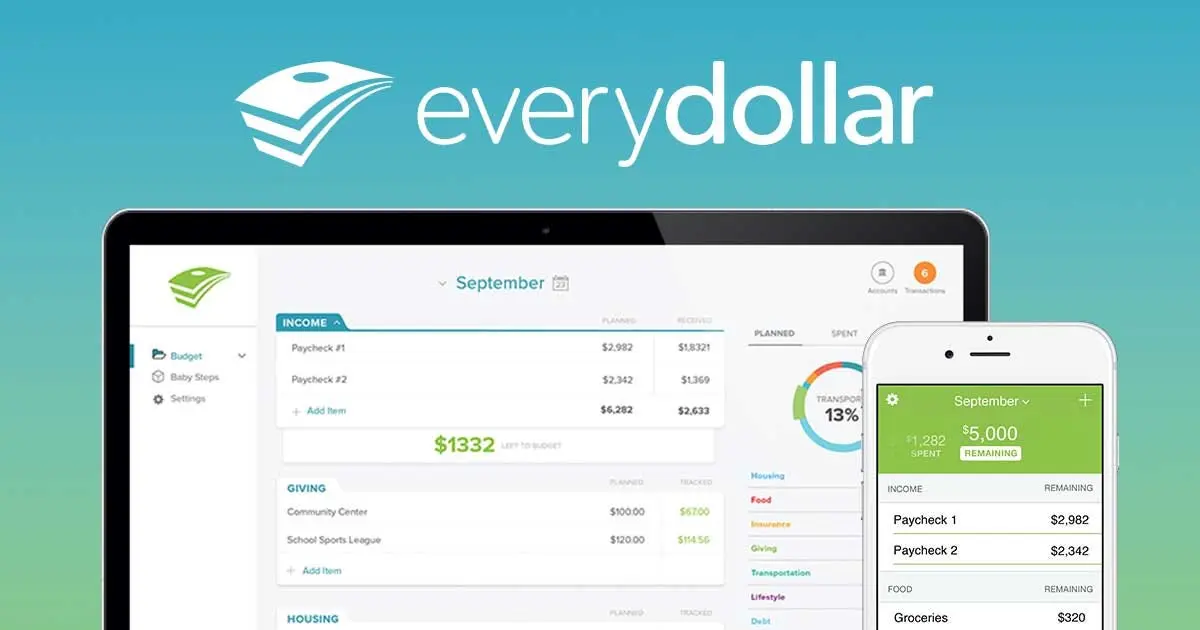

6. EveryDollar

EveryDollar is a budgeting app built on the principles of envelope budgeting, ideal for those seeking a faith-based approach to their finances. It aligns with Dave Ramsey’s Baby Steps, a financial plan that emphasizes debt payoff and wealth building. This free app allows you to create a budget, categorize your spending, and assign every dollar of your income to a job before the month begins. By visually seeing your money allocated towards specific goals, like groceries, bills, and savings, EveryDollar empowers you to make informed spending decisions and avoid overspending.

This zero-based budgeting approach ensures your income minus expenses always equals zero, giving you a clear picture of your financial situation and fostering a sense of control. With features for tracking progress towards savings goals and managing debt repayments, EveryDollar can be a valuable tool on your journey to financial freedom.

Also, read: Top 10 Largest Economies in the World

7. Mint

Mint, a pioneer in the world of personal finance apps, helped millions get their financial house in order. Launched in 2007, it offered a free and user-friendly platform to track spending, categorize transactions, and create budgets. Users loved its ability to sync with various financial accounts, giving them a holistic view of their finances. Mint also provided credit score monitoring and bill payment reminders, making it a one-stop shop for money management. However, in a surprising turn of events, Mint closed its doors to new users in March 2024.

While existing users can still access their information, those seeking a new budgeting app will need to look elsewhere. Luckily, the financial technology (fintech) space is brimming with innovative options, each with its own strengths, so finding a suitable replacement for Mint shouldn’t be too difficult.

8. Tiller Money Management

Tiller Money Management caters to the budget enthusiast who thrives in the familiar territory of spreadsheets. Unlike other apps, Tiller doesn’t impose a budgeting structure. Instead, it seamlessly connects to your bank accounts and imports transactions directly into a Google Sheet or Microsoft Excel workbook.

This empowers you to leverage the power and flexibility of spreadsheets to categorize spending, craft a custom budget, and visualize your financial progress through insightful charts and graphs. Tiller even offers a foundation template to jumpstart your budgeting journey, but ultimately, the control lies with you, making it ideal for those comfortable with a hands-on approach and a desire to tailor their finances to their exact needs.

Also, read: Top Ten Things to Consider Before Investing in Mutual Funds

9. SoFi: All-in-One Finance App for the Ambitious

SoFi isn’t just a budgeting app; it’s a one-stop shop for managing your entire financial life. Alongside its budgeting tools and goal setting, SoFi offers checking and savings accounts with competitive interest rates, commission-free stock and ETF investing, personal loans, and even mortgage refinancing.

Whether you’re looking to rein in your spending, build wealth, or pay down debt, SoFi provides the tools and resources to keep all your financial goals on track within a single app. Plus, SoFi members get perks like career coaching, financial planning consultations, and exclusive member rates on loans.

10. Qapital

This app is a great option for people who want to gamify their finances. Qapital allows you to set up rules for your money, such as automatically saving money when you reach your fitness goals or avoiding spending at certain stores. Qapital also has several features to help you track your spending and set goals. Looking for a budgeting app that makes saving fun? Qapital might be your perfect match. This app uses a gamified approach to help you reach your financial goals.

Set up custom rules to automate saving based on your spending habits. You can stash away cash for reaching your fitness goals or for avoiding unnecessary purchases at certain stores. Qapital also allows you to set traditional savings targets and track your progress visually. With its focus on making saving enjoyable, Qapital can be a great tool for anyone who wants to ditch the spreadsheet and add a little fun to their financial journey.