In 2025, navigating the car insurance market in the USA can feel overwhelming. With a record number of providers vying for your business, choosing the right policy can feel as complex as understanding a new car’s dashboard. But fear not! This guide will equip you to navigate the landscape with confidence, ensuring you get the perfect balance of coverage and affordability. We’ll break down essential coverages, explore how to compare quotes effectively, and unearth hidden discounts to save you valuable cash. By the end of this journey, you’ll be cruising the open road with peace of mind, knowing you’ve secured the best car insurance for your 2025 needs.

Also, read: Top 10 Strategies to Prepare for Rising Inflation in 2025

Don’t Get Wrecked: Ten Tips for Choosing the Right Car Insurance in the USA in 2025

In 2025, finding the right car insurance can feel like navigating a maze of options and fine print. From choosing the necessary coverage to getting the best price, securing the right plan requires some research and know-how. But fear not, driver! This guide will equip you with the top 10 tips to ensure you select the perfect car insurance policy for your needs and budget. Buckle up, and let’s find the coverage that keeps you protected on the road.

1. Consider your needs

Car insurance isn’t a one-size-fits-all deal. Diving headfirst into the cheapest option might seem like a win, but it could leave you financially stranded if a bump in the night turns into a bigger headache. The National Association of Insurance Commissioners (NAIC) reports that in 2022, over 1 in 8 drivers were uninsured in the US. Don’t become part of that statistic! Understanding your individual needs is key to crafting the perfect insurance shield.

Factors like the value of your car (think classic muscle car vs. daily commuter), your driving record (accident-free hero vs. lead foot Larry), and even how many passengers you haul around (think soccer team dad vs. solo city slicker) all play a crucial role. By taking a personalized approach, you’ll ensure you’re properly covered, avoiding a financial knockout when the unexpected hits the road.

Also, read: Top 10 Financial Literacy Resources to Educate Yourself About Money Management

2. Understand the different types of coverage

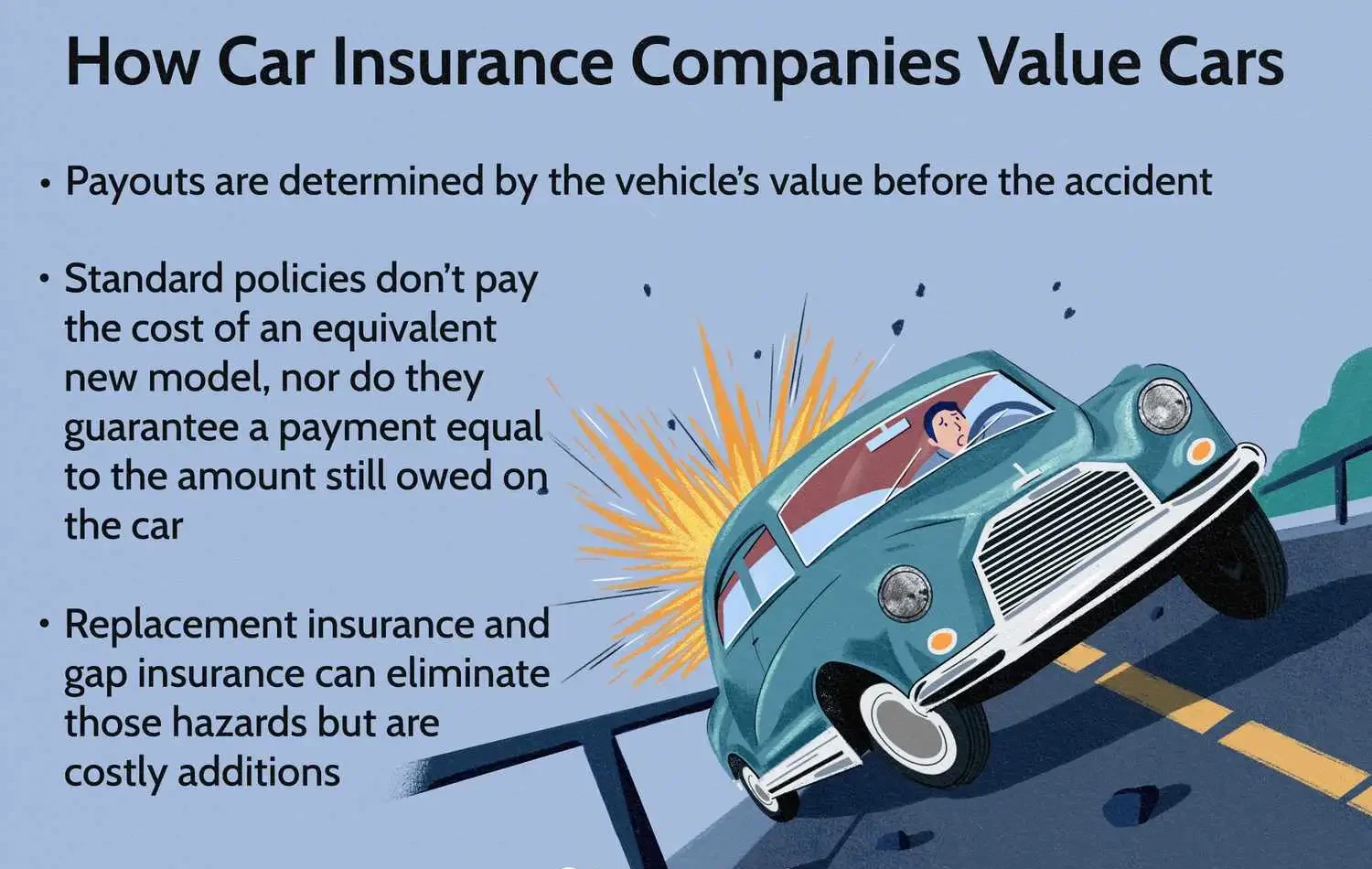

Car insurance can feel overwhelming, but understanding the different coverage types is key to making informed decisions. Required in most states, liability coverage protects others you injure or whose property you damage in an accident. It’s like a financial safety net. Collision and comprehensive coverages are optional but crucial for safeguarding your car. Collision pays for repairs if you hit another object, while comprehensive kicks in for non-collision incidents like theft, fire, or weather damage.

Consider add-ons like uninsured/underinsured motorist coverage, which shields you from drivers lacking proper insurance, and medical payments/personal injury protection (PIP), which help cover medical bills for you and passengers regardless of fault. Remember, the market offers a variety of coverage combinations; it’s not a one-size-fits-all situation. By analyzing your car’s value, driving habits, and budget, you can tailor a coverage plan that provides peace of mind without breaking the bank.

Also, read: Top 10 Financial Apps to Simplify Your Money Management in 2025

3. Shop Around and Compare Quotes: Don’t Get Stuck in Insurance Sticker Shock

Car insurance can feel like a fixed cost, but it doesn’t have to be. In a dynamic market with dozens of insurers vying for your business, there’s a good chance you’re overpaying for your current coverage. Skipping a simple comparison shopping spree could mean hundreds, even thousands, of dollars left on the table each year. The good news? Getting quotes is fast, easy, and can be done entirely online.

In minutes, you can compare rates and coverage options from national giants to regional players, all tailored to your specific driving profile and vehicle. This market analysis empowers you to find the perfect balance between affordability and protection, ensuring you get the coverage you need without burning a hole in your wallet. So, ditch the insurance complacency and dive into the world of quotes; your budget will thank you!

Also, read: Top 10 Investment Strategies for a Volatile Market in 2025

4. Ask about discounts

Don’t leave money on the table! In a competitive insurance market, companies are constantly vying for your business. This translates to significant savings for you in the form of discounts. According to a recent study by the Insurance Institute for Highway Safety Insurance Institute for Highway Safety, safe drivers can save up to 40% on their premiums.

Many insurers offer discounts for things like good driving records, taking defensive driving courses, having multiple policies with the same company, insuring low-mileage vehicles, being a student with good grades, being a member of certain professions or organizations, and even owning safety features like anti-theft devices and airbags. Be sure to ask your insurance company about all the discounts they offer and see if you qualify for any of them. By taking advantage of available discounts, you can significantly reduce the cost of your car insurance.

Also, read: Top 10 Largest Economies in the World

5. Consider your deductible

The deductible you choose significantly impacts your car insurance bill. A higher deductible lowers your monthly premium, but it also means you’ll pay more upfront if you need repairs. According to a recent survey by an insurance industry source, the average deductible chosen by US drivers in 2025 is $500. However, the sweet spot depends on your financial situation and risk tolerance. If you can comfortably shoulder a higher deductible in case of an accident, you’ll enjoy significant premium savings.

This strategy works well for safe drivers and those with older, less valuable vehicles. Conversely, if unexpected expenses would strain your budget, opting for a lower deductible provides peace of mind. Remember, filing too many small claims can affect your insurance rates, so weigh the potential cost savings of a higher deductible against the likelihood of needing repairs.

Also, read: Top 10 Largest Stock Exchanges in the World

6. Check the company’s financial stability

Finding an insurance company you can trust is crucial. Imagine getting into an accident only to discover your insurer can’t pay out because they’re financially unstable. To avoid this nightmare, look beyond the price tag and check the company’s financial strength. Independent agencies like AM Best and Moody’s analyze insurance companies and assign ratings that reflect their ability to meet future obligations, including paying claims.

A strong rating (typically A or above) indicates a lower risk of the company going bust and leaving you on the hook for a hefty bill. While a lower-rated company might offer a tempting price, the potential financial hardship down the road outweighs short-term savings. Remember, car insurance is there to protect you financially in the event of an accident, so choose a company with the strength to be there when you need it most.

Also, read: Top Ten Things to Consider Before Investing in Mutual Funds

7. Read the reviews

While getting quotes is essential, don’t underestimate the power of online reviews and testimonials in 2025’s car insurance market. Think of them as crowdsourced market research. Reviews offer a window into real customer experiences, highlighting strengths like efficient claim processing or flagging weaknesses in areas like customer service response times.

Look for reviews across multiple platforms to get a well-rounded picture. Pay close attention to how companies handle disputes and address customer concerns. Remember, these reviews aren’t just about finding the cheapest option; they’re about finding an insurer that prioritizes your satisfaction throughout the process, from quote to claim.

Also, read: Top 10 Best Real Estate Investment Strategies

8. Don’t be afraid to negotiate

Don’t be afraid to negotiate! Car insurance is a competitive market, and companies are eager to win your business. Armed with quotes from multiple providers, politely let your current or preferred insurer know you’re open to offers. Highlight your loyalty (if applicable), clean driving record, and any safety features on your car. Mention that you’re considering switching if a better deal isn’t available.

Remember, a friendly and firm approach can unlock significant savings. According to a recent study by consumers who negotiated their car insurance premiums, they saved an average of 15%. With a little effort, you could be putting that money back in your pocket!

Also, read: Top 10 Student Loan Debt Relief Programs for 2025

9. Review your policy regularly

Car insurance isn’t a set-it-and-forget-it expense. The perfect policy for your 20-year-old self cruising in a used Honda Civic might not be ideal for your life as a homeowner with a growing family and a brand-new SUV. Car prices fluctuate, your driving habits might change, and new safety features emerge. To avoid overpaying or being underinsured, schedule regular reviews of your coverage.

This proactive approach ensures you stay aligned with the market. Imagine getting a fantastic deal on car insurance, only to realize a year later that it doesn’t cover the replacement value of your car due to market price increases. By regularly assessing your needs and comparing quotes, you can stay ahead of the curve and secure the right coverage at the best possible price.

10. Be honest with your insurance company

While shopping for the best rates might be tempting, building a transparent relationship with your insurer is crucial. Insurance companies analyze vast amounts of data to assess risk, and any discrepancies between your application and reality can raise red flags. This could lead to denied claims, policy cancellations, or even higher premiums down the line.

Being upfront about your driving history, vehicle details, and mileage ensures you get an accurate quote reflecting your actual risk profile. Remember, a trustworthy policyholder translates to a smoother claims process when you need it most. So, prioritize honesty for a long-term, secure partnership with your car insurance company.

Also, read: TOP 10 WAYS TO GET STUDENT LOAN DEBT RELIEF

FAQs: Choosing the Right Car Insurance in the USA in 2025

Q. What is the most popular car insurance in the US?

State Farm is the biggest auto insurance company in the country by market share, while Progressive, Geico, and Allstate are the next three.

Q. Is car insurance a must in the USA?

Car insurance laws are set and enforced at the state level, and 49 of the 50 states in America require all drivers to carry an active car insurance policy. New Hampshire is the only state in which you are not legally required to have car insurance, as long as you can show proof of financial responsibility.

Also, read: 10 Things You Should Know About Bond Ladder Strategy

Q. How much car insurance do I need?

This depends on your car’s value, driving habits, and risk tolerance. The minimum state requirements might not be enough. Consider full coverage (collision and comprehensive) for newer cars or loans, and liability limits that cover potential costs in accidents.

Q. Is pay-per-mile car insurance worth it?

Maybe! It’s gaining traction, especially for low-mileage drivers. These plans track your driving and charge based on miles driven. Research carefully, though, as frequent drivers might end up paying more.

Q. How can I save money on car insurance in 2025?

- Compare quotes: Don’t settle for the first offer. Get quotes from several insurers; it can make a big difference.

- Ask about discounts: Many insurers offer discounts for good driving records, bundling policies (home & auto), safety features, and even student status.

- Increase your deductible: A higher deductible lowers your premium, but you’ll pay more upfront for repairs.

- Consider usage-based insurance: Pay-per-mile plans can save money for low-mileage drivers.

Also, read: Top 10 Charles Schwab Roth IRA Benefits

Q. What are some things that can unexpectedly raise my car insurance rates?

- Traffic tickets and accidents can significantly increase your premium.

- Moving to a new location with higher accident rates could impact costs.

- Adding young drivers to your policy can also raise rates.

Q. Should I use an insurance agent or shop online?

Both have pros and cons. Agents offer personalized advice, but online comparison tools can save time and provide a wider range of quotes. Consider your comfort level and research needs.

Conclusion: The Final Thought

As you navigate the complex landscape of car insurance in the USA, prioritize policies that offer comprehensive coverage, competitive premiums, and excellent customer service. Don’t hesitate to shop around and compare quotes from different insurers to find the most suitable option. By investing time and effort in selecting the right car insurance, you can safeguard your financial future and drive with peace of mind.

In conclusion, finding the right car insurance in 2025 is about understanding your needs, comparing options, and prioritizing the right balance of coverage and cost. By following these ten tips, you can navigate the car insurance landscape with confidence, ensuring you have the financial protection you need to drive safely and securely. Remember, the best car insurance policy is the one that meets your specific needs at a competitive price. So, take your time, shop around, and don’t be afraid to ask questions before making your final decision. Happy driving!