Forget hustling for more cash—mastering the art of saving can be just as powerful! It’s not about sacrificing fun, it’s about spending smarter, not harder. These top 10 ways to save money will help you tackle those rising bills without feeling deprived. Plus, even small savings add up. Invest in them, even at a low rate, and watch your future self Thank you!

Think of it this way: are you paying the “fixed” costs you think you are? Renegotiate insurance premiums, ditch cable for streaming services—these seemingly unchangeable expenses can be surprisingly flexible. Finally, don’t underestimate the power of small cuts. Reducing everyday spending can instantly free up cash to offset inflation’s sting. So, keep reading to discover the top 10 ways to save money in 2025!

The potential payoffs increase more dramatically still if you also shrink some ongoing expenses that are often mistakenly treated as if they were fixed; insurance premiums, for example, or cable bills. In the short term, cost-cutting moves can also immediately help offset the rising costs of living due to inflation.

Also, read: Top 10 Strategies for Building Wealth in a High Inflation Environment

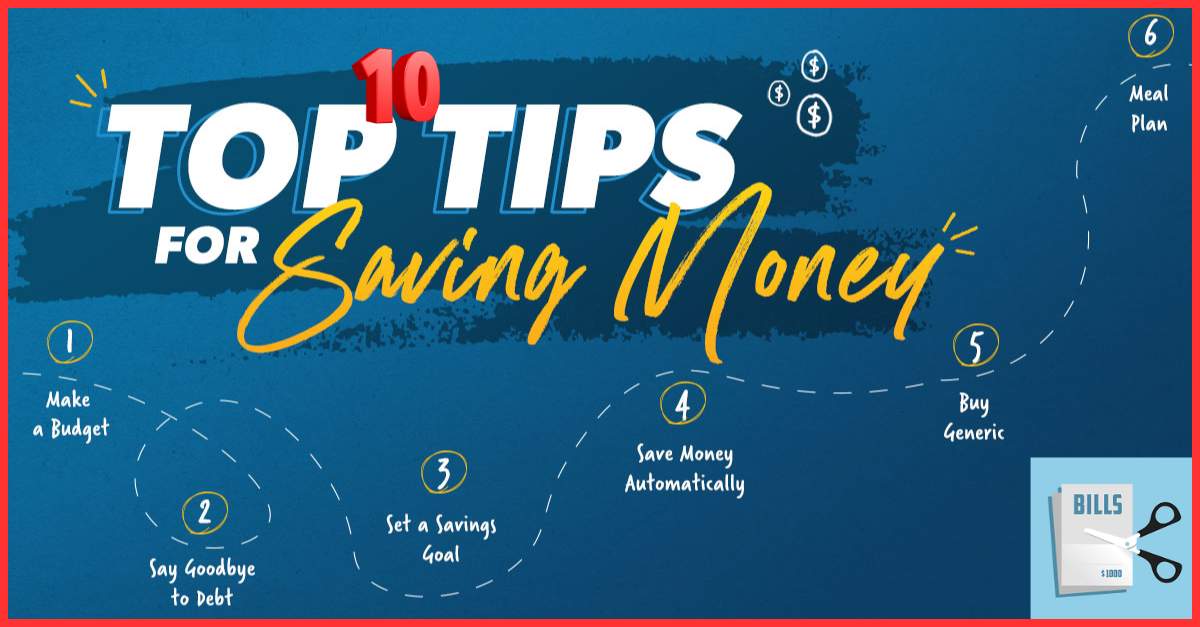

Unlock Your Financial Freedom: 10 Keys to Saving Money in 2025

Let’s face it, 2025 has brought its fair share of financial challenges. From rising grocery bills to gas prices that seem to defy gravity, everyday expenses are putting a strain on wallets everywhere. But fear not, penny pinchers! There’s hope yet. In this blog, we’ll dive into the top 10 ways to save money on everyday expenses in 2025. We’ll explore clever hacks, budgeting strategies, and practical tips to help you stretch your hard-earned cash further. So, buckle up and get ready to transform yourself into a money-saving superhero!

1. Track your spending

Ever feel like money mysteriously disappears each month? You’re not alone! But before you can save, you need to understand where your money goes. Tracking your spending is the essential first step to financial awareness. Luckily, there are several ways to do this. Many banks offer free budgeting tools that automatically categorize your transactions. Spreadsheets and budgeting apps are also fantastic options, allowing you to customize categories and track spending trends.

The key is to find a method that works for you, something you can easily update after every purchase, big or small. By diligently tracking your spending for a month, you’ll gain invaluable insights. You might be surprised to see where hidden expenses lurk, empowering you to make informed choices and free up cash for your savings goals.

Also, read: Top 10 Tips for Choosing the Right Car Insurance in the USA in 2025

2. Slash subscriptions

Subscription boxes, streaming services, monthly software fees—they all seem like small charges, but they can add up quickly. This year, take control by auditing your subscriptions. Ask yourself: Am I actively using this service? Do I get enough value to justify the cost? Consider rotating entertainment subscriptions like Netflix or Hulu, or utilizing free ad-supported tiers.

Explore free and open-source software alternatives for basic tasks. Remember, you can unsubscribe anytime, so don’t be afraid to try a service for a month and cancel if it doesn’t meet your needs. By taking control of your subscriptions, you’ll free up cash for the things that truly matter

Also, read: Top 10 Strategies to Prepare for Rising Inflation in 2025

3. Embrace budgeting

While budgeting might sound restrictive, it’s a powerful tool that empowers you to take control of your finances and achieve your goals. Imagine feeling confident, knowing exactly where your money goes each month. By creating a budget, you allocate your income towards essential expenses, savings goals, and even some fun! There are many free budgeting apps and online resources to make it user-friendly.

Don’t be afraid to personalize it; find a system that works for you. Think of budgeting as a roadmap to financial freedom in 2025; it gives you the power to make informed choices about your spending and save for the future you deserve.

Also, read: Top 10 Financial Literacy Resources to Educate Yourself About Money Management

4. Renegotiate bills

Are you feeling squeezed due to your monthly bills? Don’t just accept them as fact! Cable, internet, phone, gym memberships—many recurring expenses offer wiggle room. Channel your inner negotiator and call your service providers. Be polite but firm, mention your loyalty as a long-term customer, and inquire about current promotions or retention deals.

Research competitor plans beforehand to strengthen your bargaining chip. Mention that you’re open to switching if they can’t offer a more competitive rate. Finally, be happy to bundle services or remove unnecessary features to reach a win-win agreement. Remember, the worst they can say is no, and the best-case scenario could save you hundreds over a year!

Also, read: Top 10 Financial Apps to Simplify Your Money Management in 2025

5. Master the grocery game

Conquering the grocery aisle can feel like a battle against inflated prices. But fear not, penny pinchers! Here’s how to be a grocery game champion: Plan meals to avoid impulse buys, and stick to a grocery list. Utilize digital and paper flyers and coupons for discounts. Embrace generic or store-brand staples that offer similar quality for less. Don’t be afraid to get friendly with the butcher or produce manager for deals on near-expiration items.

Finally, unleash your inner chef! Cooking most meals at home is significantly cheaper than eating out. Leftovers become tomorrow’s lunch, and you get the satisfaction of delicious, budget-friendly home cooking. By planning, using coupons, embracing store brands, and prioritizing home-cooked meals, you’ll transform your grocery trips from battlefield to victory lap.

Also, read: Top 10 Investment Strategies for a Volatile Market in 2025

6. Cook more at home

Dining out is a delicious but expensive trap. Break free and explore the money-saving magic of home cooking! Budget-friendly meals don’t have to be bland. With a little planning, you can whip up healthier, tastier dishes than takeout, all for a fraction of the cost. Plan meals around weekly grocery flyers, embrace versatile staples like beans and lentils, and get creative with leftovers for delicious lunches.

Not only will your wallet thank you, but you’ll gain control over the quality of ingredients and discover the satisfaction of creating satisfying meals at home. So ditch the delivery menus, dust off your pots and pans, and embark on a culinary adventure that’s kind to your taste buds and your bank account!

Also, read: Top 10 Emerging FinTech Trends Transforming Personal Finance in 2025

7. Be a savvy shopper

Don’t let clever marketing schemes or impulse buys drain your wallet! Channel your inner bargain hunter and become a savvy shopper in 2025. Comparison shop online and in-store before making a purchase, especially for pricier items. Utilize digital tools like price trackers and browser extensions to snag the best deals. Embrace store loyalty programs and clip coupons whenever possible.

Don’t be afraid to consider generic or store-brand alternatives; you might be surprised by the quality! Think long-term; buying a well-made item that lasts might be a better investment than a cheaper, lower-quality option. Finally, gently used items can be a goldmine for significant savings. With a little research and planning, you can be a savvy shopper and stretch your hard-earned dollars further this year.

Also, read: Top 10 Financial Planning Tips for Money-Savvy Americans in 2025

8. Embrace free entertainment

Who says entertainment has to break the bank? In today’s digital age, there’s a treasure trove of free or low-cost ways to have a blast. Ditch the expensive outings and explore your city’s parks for picnics and frisbees, or delve into the world of free museum days. Public libraries often host author talks, movie screenings, and even game nights.

Craving a good show? Many local theaters offer free performances, or you can gather friends for a potluck movie marathon with classic films available on free streaming services (with ads). Unleash your inner artist with free online tutorials for painting, music, or writing, or organize a board game night with friends—laughter is always free! Remember, a little creativity can unlock a world of budget-friendly entertainment, leaving you with more money for the things that truly matter.

Also, read: Top 10 Highest Currencies in the World

9. Harness the power of free apps

In today’s digital age, there’s an app for practically everything! But who says you need to spend a dime to unlock entertainment and productivity? Free apps abound, waiting to become your secret weapons in the fight against everyday expenses. Craving a good book? Dive into the world of free ebooks with Libby or Project Gutenberg. Want to unwind with some music? Spotify’s free tier offers ad-supported tunes, while YouTube provides a vast library of music videos (with some commercials).

Even movie buffs can get their fix with free apps like Tubi or Crackle, which feature a selection of ad-supported films and TV shows. And that’s not all! Free language learning apps like Duolingo gamify education, while fitness apps like Nike Training Club keep you moving without a gym membership. So ditch the cable bill, unsubscribe from unused services, and explore the treasure trove of free apps that can enrich your life and keep more money in your pocket.

Also, read: Top 10 Largest Economies in the World

10. Challenge yourself

Saving money doesn’t have to mean sacrificing enjoyment. Why not make it a game? Challenge yourself to a no-spend weekend or a “treat yourself” jar. During a no-spend period, see how you can have fun with free activities—explore local parks, visit museums with free admission days, or have a game night with friends. Every time you resist an impulse purchase, toss some spare change in a treat jar.

Once the jar fills up, reward yourself with something you’ve been wanting, guilt-free, because you earned it by saving! These challenges not only boost your savings but also make mindful spending a habit and help you discover free and creative ways to entertain yourself. So, unleash your inner champion and playfully tighten your budget—you might be surprised at how much fun you have while saving for your goals!

Also, read: Top 10 Largest Stock Exchanges in the World

FAQs: Strategies for Building Wealth in a High Inflation

Q. How Can I Save Money Each Month?

You can save money by putting expenses on a cash-back credit card, but only if you pay the full balance at the end of the month. You can also save by switching to a cable or mobile phone provider offering lower rates.

Q. Are there budgeting apps that work?

Absolutely! There are tons of free and paid budgeting apps. Some popular options include Mint, YNAB (You Need a Budget), and PocketGuard. The best app depends on your financial personality. Try a few to see which one keeps you engaged and organized.

Also, read: Top Ten Things to Consider Before Investing in Mutual Funds

Q. Can I save money by meal planning?

Yes! Meal planning helps you avoid impulse purchases at the grocery store and reduces food waste. Plus, it can be a fun way to explore new recipes and discover budget-friendly staples.

Q. Is it safe to buy generic or store-brand groceries?

Generally, yes! Generic and store-brand groceries are often just as good as name brands but for a fraction of the price. Do a taste test to see if you notice a difference.

Q. How often should I renegotiate my bills?

There’s no hard and fast rule, but calling your cable company, internet provider, or even your cell phone service provider every year or two can save you a lot of money. Be polite, and persistent, and mention that you’re a loyal customer looking for a better deal.

Also, read: Top 10 Best Real Estate Investment Strategies

Q. What are some free or low-cost ways to entertain myself?

The free entertainment options are endless! Explore your local parks, and libraries (many offer free museum passes!), or attend community events. There are also tons of free workout videos online, or you could start a book club with friends.

Conclusion: The Final Thought

In today’s economic climate, finding Ways to Save Money has become more crucial than ever. By implementing even a few of these top 10 strategies, you can significantly reduce your everyday expenses and boost your savings. Remember, small changes can lead to big savings. From smart grocery shopping to energy-efficient habits, every penny counts. By adopting these Ways to Save Money, you can take control of your finances and achieve your financial goals. So, why wait? Start saving today and watch your money grow!

Also, read: Top 10 Student Loan Debt Relief Programs for 2025